Surging Demand for Sustainable Solutions: Paper Packaging Gains Traction in the $73.5 Billion MEA Packaging Market

In the rapidly growing Middle East and Africa (MEA) packaging market, the share of paper packaging has been on a steady rise, currently contributing to the estimated $74 billion market. This surge is primarily attributed to the flourishing e-commerce sector and a notable shift in consumer preferences towards sustainable and eco-friendly solutions.

According to industry experts participating in the eminent B2B exhibition, Propaper 2023, investments in kraft paper mills have escalated in the region post-Covid, driven by the heightened use of paper packaging in various industries such as food, catering hygiene, pharmaceuticals, and cosmetics.

Set to take place from September 12-14 at the Festival Arena in Dubai Festival City, Propaper Dubai 2023 is expected to host a significant number of global paper and packaging companies at the forefront of innovation. The event, which incorporates Super Sourcing Dubai under the Federation of Indian Export Organisations (FIEO), aims to facilitate partnerships, joint investments, market exploration, and increased sales for the participants.

Majid Rasheed, Managing Director of Star Paper Mill Paper Industry in the UAE, emphasized the surge in e-commerce in the GCC and larger MEA markets, projecting that the overall e-commerce market in the region might exceed $25 billion in the next few years. This, in turn, is expected to bolster the demand for paper packaging solutions, presenting significant opportunities for the sustainable paper industry.

Citing a report from Data Bridge Market Research, the representatives at Propaper 2023 anticipate continued growth in the kraft paper market, with a projected CAGR of 3.8 percent in the UAE alone, reaching over $54 million by 2028.

Omar Ali Abdullah Al Hosni, Chairman of Keryas Paper Industry in Oman, highlighted the growth in the paper food packaging sector, which gained momentum during and post the pandemic. He underlined the increasing adoption of paper packaging solutions in sectors like pharma, personal care, and cosmetics, driven by the burgeoning e-commerce trend and high internet penetration in the GCC.

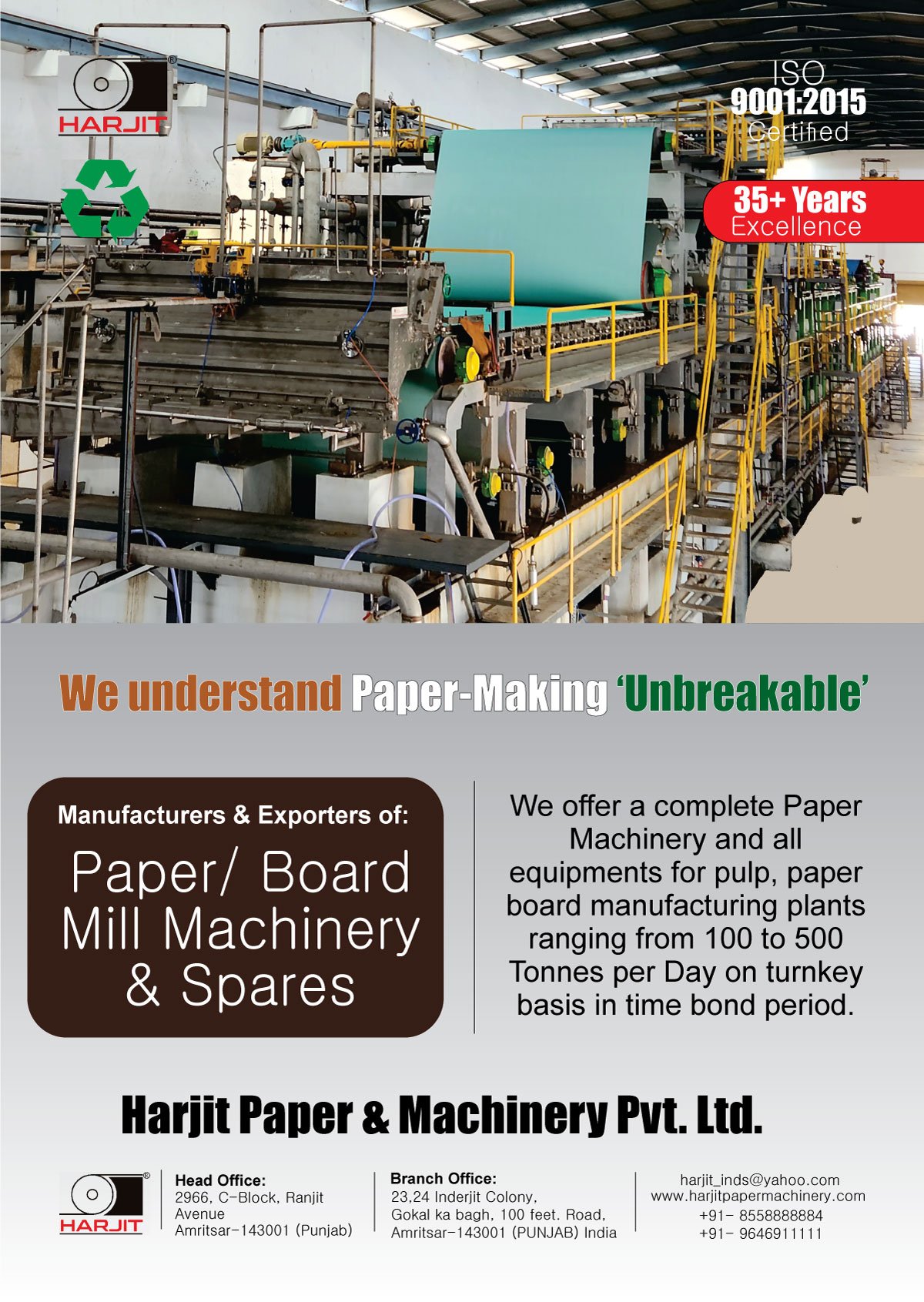

In anticipation of the surge in demand, Keryas Paper Mills had announced investments in the kraft paper segment, unveiling a $40 million kraft paper project in the UAE during the previous Propaper expo in 2022. Similarly, Star Paper Mills had also announced investments in the kraft paper segment, partnering with RC Paper Machines for an investment of over $54 million in Khalifa Economic Zones Abu Dhabi (KEZAD) to manufacture recycled kraft paper jumbo reels.

According to a report by Mordor Intelligence, the B2C and B2B paper packaging solutions in the MEA region are estimated to grow at a CAGR of 4.30 percent during 2023-2028, reflecting the sustained expansion and potential in the paper industry.

Jeen Joshua, Managing Director of Verifair, reiterated the industry’s notable surge in investments, both in existing and new projects, driven by the consistent rise in the market for paper-based products. He emphasized the pronounced growth in the GCC region, fueled by a digitally adept and sustainability-conscious young population driving increased online spending.

Furthermore, the article highlighted the participation of Indian companies as the largest exhibitor contingent at Propaper 2023, with China and Egypt also joining as pavilion participants. This participation is in line with the burgeoning bilateral trade between India and the UAE, with the non-oil trade touching $50.5 billion from May 2022 to April 2023, indicating a notable 5.8 percent increase.

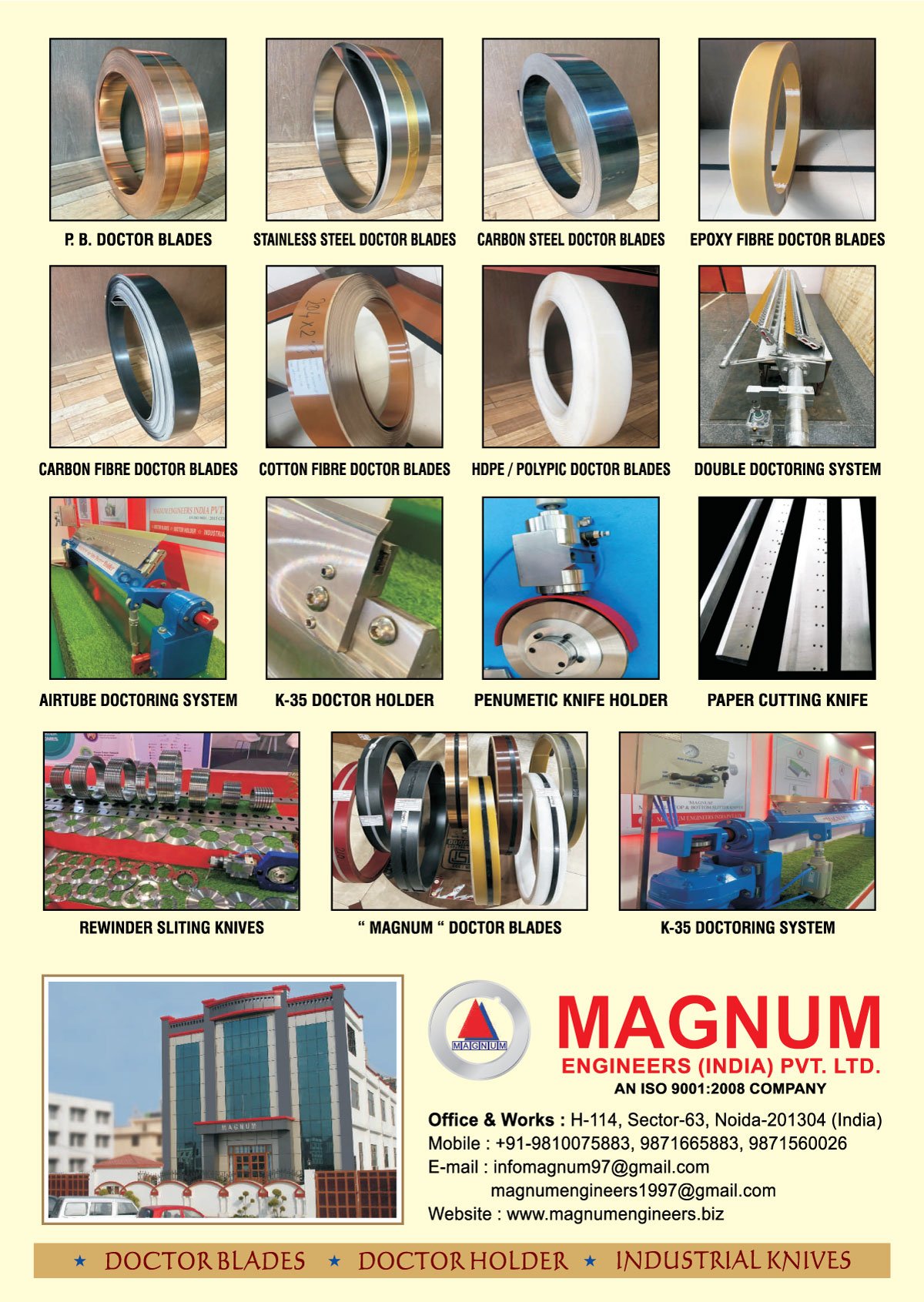

Propaper 2023 is positioned as a pivotal platform for paper industry stakeholders to converge, display products, and explore partnerships and growth opportunities. As the event gears up for its second year, it aims to facilitate crucial alliances, market entries, and increased sales for all participants. The exhibition will host a diverse array of paper industry companies, spanning from corrugated paper board manufacturers to paper mill machinery producers, as well as tissue and converting machinery, along with printing and packaging equipment.